There are hundreds (if not thousands) of recruiting tools to help improve the end-to-end recruiting process. The solutions are out there, but why does it have to be so hard to be able to use them? Why do enterprises only leverage a fraction of the excellent offerings on the market to optimize the full hiring and candidate experience?

Here’s why:

- Recruiters and Recruiting Coordinators hate friction in their tools

- For better or worse, the ATS is the data engine that drives the recruiting process.

- ATS companies have traditionally been slow to innovate and resistant to 3rd party integrations

- Point solutions can innovate faster and solve more recruiting workflows than the large ATS companies

- Point solutions/3rd Parties need to prioritize who they partner/integrate with

- Recruiters and Recruiting Coordinators hate friction in their tools

Recruiters and coordinators have more than enough to keep them busy, the last thing they are looking for is one more thing to do or tool to use. Adding another step to their process without a significant improvement to their productivity or business results will be met with significant resistance. Unless it is drop-dead easy to see the benefits, adoption will not happen. Here are the pet peeves that drive recruiters and coordinators nuts and cause unnecessary friction in their daily work process:

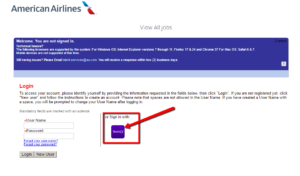

- Needing to sign into multiple systems to manage the hiring process. Tools need to be one click away with single sign on (SSO). Don’t make them sign in to each tool and ensure ease of access to an application via a simple click on a button, tab, link, or icon.

- Double entry of data that already exists elsewhere. Information that already exists in your ATS should not need to re-entered or copy/pasted. As will be discussed in #2, integrating data between tools can be non-trivial.

- Poor usability. Given the overhead burden put into the process due to compliance, traditionally, usability has been compromised to make sure that all the ‘cover your butt’ features have been crammed into each step in the process. The latest generation of ATS companies have included the consumerization of recruiting tech into their design, but still, there is a long way to go to make most tools easy to use and mobile-friendly.

- For better or worse, the ATS is the data engine that drives the recruiting process.

For nearly every company the ATS is the central database for all job and candidate information. While some larger companies have created their own master HR database, they are more the exception than the rule. Nearly every significant task for sourcing or selection uses information from the ATS database as the content source. As mentioned above, recruiters and coordinator know what information already exists for a Job or Candidate and they have no interest in re-entering data that they know already resides in another system. Doing so is frustrating and naturally causes frustration and increases adoption issues for new tools. Thus not being able to easily synch data between tools can be a deal-killer for recruiting teams. Given the importance of the data stores in the ATS database, ATS companies exert tremendous power over what is possible for your team to adopt. The constraints your ATS puts on your capabilities and the implications of access to job and candidate data are something to seriously understand for your hiring and candidate experience process.

- ATS companies can’t build everything themselves and they traditionally have not been open to 3rd party integrations

Taleo and other first-generation ATS companies started as products to apply supply-chain management operational efficiencies to recruiting. Furthermore, government-required compliance reporting acted as a catalyst to accelerate large enterprise adoption. While these systems had appeal to HR executives by focusing on organizational productivity and keeping themselves out of jail, they did not focus on the real ATS customers and users: candidates and recruiting teams.

Given these design priorities, the end-user experience primarily focused on work-flow management and exhaustive data capture – none of which resulted in a great user-driven experience. In recent years, much of the focus has been on getting some of the table-stakes such as a decent search function to treat the database like a CRM tool. Also, basic performance issues and creating mobile-friendly tools.

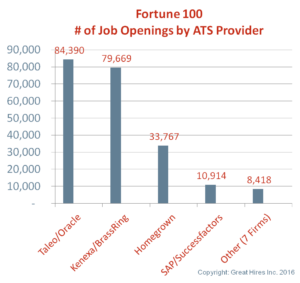

If job or candidate related information needs to be used or updated by a 3rd party tool, then it requires some integration to allow for data exchange. The challenge with first-generation ATS systems (e.g. Taleo, Kenexa/Brassring) is that they are pretty much closed system with poor (non-RESTful) APIs to allow for easy integration. Even worse, these incumbents charge multiple tens of thousands of dollars for the privilege of being an integration partner, deterring any small or medium sized company from working with them. Newer ATS companies (e.g. Workday, iCIMS and Greenhouse) are much more open, simpler to integrate with and trying to become ecosystems, but the challenge for developers is the effort needed to create custom integration points for each platform integration (similar to creating an app for both iOS and Android). Aptitude Research Partners just published a phenomenal review of the current prominent ATS systems and details the strengths and weaknesses of each platform.

- Point solution tool companies can innovate faster and solve more recruiting workflows than the large ATS companies

You would think with all the resources of Oracle and IBM, Taleo and Kenexa/BrassRing would be leaders in talent acquisition innovation. Instead they are not only laggards, but they also seem handcuffed to their old-school enterprise software mentality and business models. Social, mobile and cloud are not in their DNA which has caused them to be slow in reinventing themselves and their platforms. An easy example of this is the emergence of the recruitment marketing category with companies such as Jibe, Smashfly and Phenom. In recent years as both the economy and hiring have rebounded, a solution for nearly every recruiting task has been created. Whether it is for job description optimization, big data applied to resume analysis or a new twist on social, mobile sourcing there’s an app for that. By not having a one-stop-shop platform provided creates the need for a ‘best-of-breed’ recruiting technology strategy and then a plan to figure out how to make all these solutions to work together. For leading edge companies with sophisticated talent acquisition organizations like Google and Amazon, they have responded by building their own integrated platforms to match their unique recruiting methods. However, most companies do not have the resources or skills to build their own recruiting ecosystem themselves.

- Tool companies need to prioritize with whom to integrate

In an ideal world there would common standards that any recruiting tool company could use to integrate into any ATS ecosystem. While the HR Open Standards consortium is making progress, there is still a long way to go to meet the needs of most recruiting technology companies.

With over 200 applicant tracking systems, none of which have a dominant market share, having a fragmented ATS market is forcing recruiting tool companies to individually choose which ATS company to choose as an integration partner. Without common standards and well supported APIs / partner programs, only a few ATS companies will likely have the scale needed to support a deep ecosystem. Companies like iCIMS, SmartRecruiters and Greenhouse are trying to get there, but there is still a long way to go to make a full suite of recruiting tools as easy as plug-and-play. Until adding any recruiting tool to your ATS is as simple adding an app like your iPhone or Salesforce, there is no effortless solution.

The good news is that recruiters have some powerful tools available to them to solve their acquisition challenges . However, unless these new technology solutions can overcome the hurdles that the dynamics of the incumbent enterprise platforms create, it will take many years for talent acquisition professionals to be able to fully take advantage of them.

About the Author: Ray Tenenbaum is the founder of Great Hires, a recruiting technology startup offering a mobile-first Candidate Selection platform for both candidates and hiring team success. Ray has previously spent half of his career building Silicon Valley startups such as Red Answers and Adify (later sold to Cox Media); the other half of his career was spent in marketing and leadership roles at enterprise organizations including Procter & Gamble, Kraft, Booz & Co. and Intuit. Ray holds an MBA from the University of Michigan as well as a bachelor’s in chemical engineering from McGill University.

Follow Ray on Twitter @rayten or connect with him on LinkedIn.